Paying down your mortgage but not making headway…

Are you one of the many Canadians who feel like it is taking forever to pay down your mortgage balance? You receive your annual mortgage statements and your mortgage balance seems to decrease “just a bit” and you see the large amount that you have paid for interest in the past year.

There is a reason why your mortgage balance is decreasing so slowly and it has to do with the frequency of your mortgage payments.

Consider the following scenario:

You have just purchased a home and your lender is offering different payment frequency options. What payment frequency should you choose?

Assumptions:

$500,000 Purchase, with 20% down-payment,

Mortgage = $400,000

Amortization = 25 years; fixed mortgage with a rate of 2.8%; 5-year term

Which payment frequency is best?

To begin to answer this question, we need to define each payment frequency:

Monthly: The stated monthly principal and interest payment that is given on a mortgage commitment;

Bi-Weekly: The sum of the total monthly payments for the year divided by 26 periods (you are making payments every 2 weeks on the 52 weeks of the year);

Accelerated bi-weekly: One extra month’s payment is added. You take your stated monthly mortgage payment and multiply it by 13 and then divide it by 26 periods. It is also calculated as your stated monthly mortgage payment divided by 2.

Weekly: The sum of the total monthly payments for the year divided by 52 weeks;

Accelerated Weekly: One extra month’s payment is added. You would take the 13 monthly payments and divide by the 52 weeks in a year. As many lenders may define the payment frequency options differently, it is important to understand their payment frequency definitions.

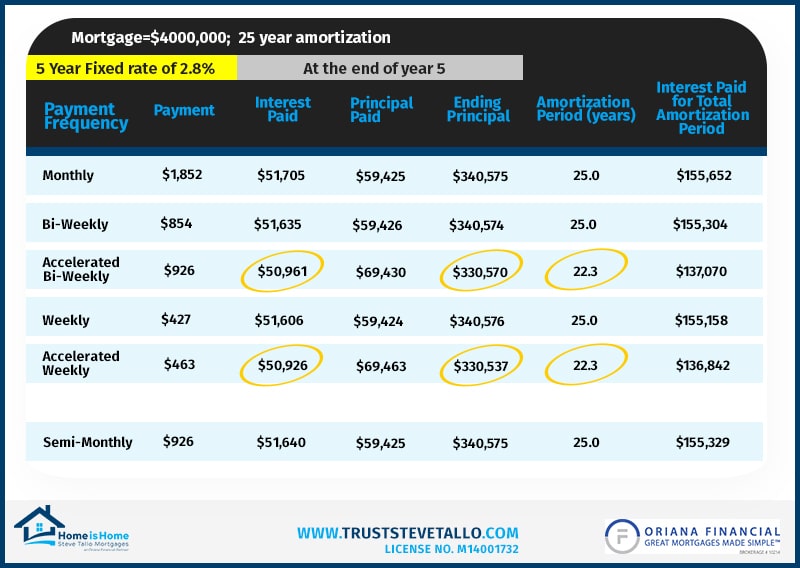

The chart below summarizes the various payment options available:

What payment frequency is the best option?

What can clearly be seen is that the accelerated payment frequency, whether bi-weekly or weekly, offers the lowest amount of interest paid over the 5-year term, the lowest principal at the end of 5 years and your mortgage is paid-off about 2.7 years earlier. The interest savings over 25 years is around $18,000.

This chart emphasizes one key fact, the accelerated payment frequency is so important because more of your mortgage payment is going to pay down principal. As you pay-down more principal, more of your next payment goes to the payment of principal (and not interest).

First-time homebuyer clients often say to me that they would prefer to pay monthly. They give the reason that it is easier to keep track of the payments. However, when I show them the interest cost savings by going with an accelerated payment frequency, they take the accelerated option. They realize that the interest savings will help to fund their children’s education or help pay for a wedding…all by simply making an extra monthly payment each year.

Some banks will say, “Go with a monthly payment frequency and then you can make pre-payments”. This is true but it ignores the fact that so many borrowers simply stay with their monthly payments and don’t make the pre-payments. By going with an accelerated payment frequency, you are forcing a pre-payment; that extra one-month payment in the year sure makes a big difference.

Please contact me for more information. I’m here to help you realize your dream of truly owning your home as soon as possible.

Not Sure Where To Start?

Start with the

Top Questions To Ask Your Mortgage Agent!

- The Bank of Canada lowers its benchmark rate to 4.75% - June 7, 2024

- What the Bank of Canada rate hold means for you - March 7, 2024

- Thinking of a home renovation? Unlock the potential of your mortgage - February 18, 2024